In recent years, the dynamics of payment culture has seen a worrying shift towards slow and late client payments, something which especially impacts small and medium-sized enterprises (SMEs). In response to this, the Business Travel Association have worked with Good Business Pays and Small Business Commissioner to bring together a guide for SME’s around slow and late payments.

What are the problems with payment culture in B2B companies?

Payment culture in B2B companies can vary significantly from one organisation to another. While not all B2B companies have issues with their payment culture and ensure all payments are made in good time, several common problems can arise in this area if payments are late or just before a deadline.

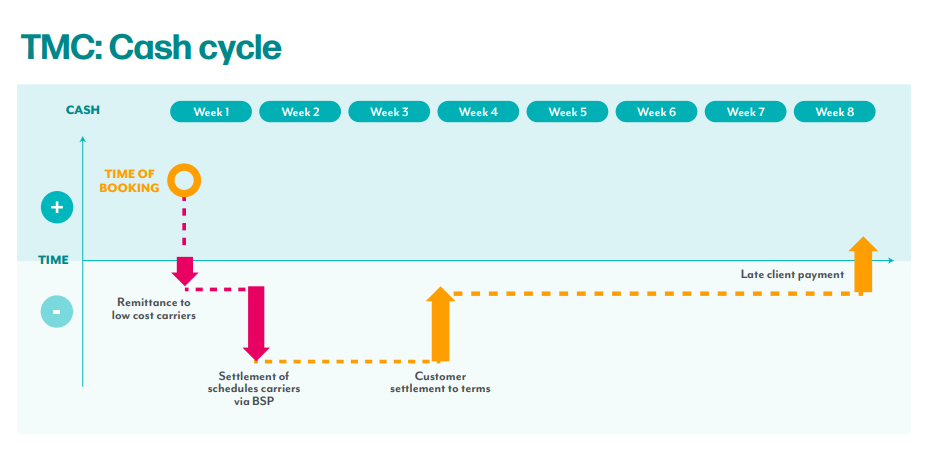

BTA members have reported over the last 12 months a worrying increase in late client payments, with over 20% of debt being over 30 days from the due date, double pre-pandemic times. It is clear some corporates are using late payment to bolster their own working capital positions.

The current regime of late payment interest charges is not an effective remedy. Often, our BTA members are reluctant to raise the issue of late payment interest charges with their clients. Equally, many TMCs do not have the technological solutions in place to automate the calculation of late payment interest charges and the subsequent invoicing. Whilst the reporting of companies who repeatedly pay late exists, there is very little awareness or visibility of this.

What are the risks of small businesses getting paid late?

Late payment disproportionately impacts small and medium-sized businesses, often casting an uncertain shadow over their financial stability. Due to their smaller scale, these businesses can struggle to bridge financial gaps caused by late payments, encountering challenges securing temporary financing, and grappling with less robust credit management systems. Consequently, late payments can thwart a business’s capacity to invest in opportunities to grow.

Late payments can take a huge toll on SMEs’ ability to function, going beyond cash-flow issues, encompassing a wide range of detrimental effects including time and resource drain (it can take hours to monitor and chase over-due payments), debts, growth stagnation, staff salary difficulties, increased borrowing, directorial sacrifices (it is common for directors to forego their salaries to ensure staff are paid and other payments are met) and the mental health of business owners.

What successes have small business seen when payment is fast?

SMEs often experience valuable positive outcomes when payments are processed quickly, such as enhanced liquidity, improved health of the business and an enhanced reputation.

Why do large companies want to (or not) work with small businesses?

Small businesses can often offer a more bespoke and personalised service, tailored to the needs of a larger company. Collaborating with a small business can also foster a sense of partnership built on closer relationships and a tight-knit team.

However large companies might worry about the the financial stability of a smaller business if they are struggling due to late payments. Ultimately, payments not being made on time can not only cause apprehension among SMEs but also extinguish potential business opportunities between larger and smaller companies. Large corporations may view cash flow issues arising from delayed payments as a deterrent to collaboration, meaning SMEs suffer further consequences.

How to avoid late payments

As the former Small Business Commissioner, and with a 40-year career in credit management, Philip King developed a proven model (Philip King Five-Step Model – Business Survival by getting paid), to help SMEs avoid the issues related to late payments. Here he sets out a number of guidelines and recommendations which small businesses should consider adopting with regard to their approach to payments:

Clear Payment Terms: Ensure that payment terms are clearly defined in contracts or agreements with all clients. Clearly stipulate the payment due dates, late payment penalties, and any interest charges for overdue payments.

Prompt Invoicing: Issuing invoices promptly after providing goods or services is crucial. Timely invoicing plays a key role in establishing the anticipated payment schedule and kick-starting the payment process in a timely manner. Ensure the invoice prominently displays the due date and the bank account to which payments should be made.

Regular Follow-Ups: Implement a system for regular follow-ups on outstanding invoices. Establish a schedule for payment reminders via email, phone calls, or automated reminders to prompt clients about upcoming or overdue payments. Don’t procrastinate; escalate internally and, if that doesn’t work, utilise the services of a third party. Keep your invoices at the top of the list for payment. Always do what you said you were going to do when you said you were going to do it.

Flexible Payment Options: Provide multiple payment methods to make it convenient for each of your clients to pay. Offering online payment options or various modes of payment can expedite the payment process.

Engage in Relationship Building: Developing strong relationships with clients can significantly impact payment timelines. Although it shouldn’t be a requirement for timely payments, fostering positive relationships often results in quicker transactions. Clear communication and a positive relationship can lead to better adherence to agreed – upon payment terms. Learn, and follow closely, the client’s requirements for processing invoices, and make friends with people on the Accounts Payables team who will be processing payments.

Implement Late Payment Penalties: Enforcing late payment penalties for overdue invoices, as previously agreed in the initial contract, can act as a deterrent for clients who might otherwise delay payments. This measure not only encourages adherence to the agreed payment schedule but also serves as a mechanism to deter delays in settling invoices. Even if not included within the contract, late payment interest and penalties can be charged under the Late Payment of Commercial Debts Act.

Utilise Technology: Take advantage of accounting and invoicing software to automate the invoicing and payment tracking procedures. These tools offer a streamlined approach to invoicing and aid in tracking payments efficiently. Additionally, they can generate alerts for overdue payments, facilitating better management of outstanding invoices

Read the full guide here.